October JOLTS data weaker than expected

___

Published Date 12/5/2023

Today's Mortgage Rate Summary

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up.

Rates Currently Trending: Neutral

Mortgage rates are getting a small boost. The MBS market worsened by -25 bps yesterday. This may have been enough to increase mortgage rates or fees. The market experienced high volatility yesterday.

Today's Rate Forecast: Neutral

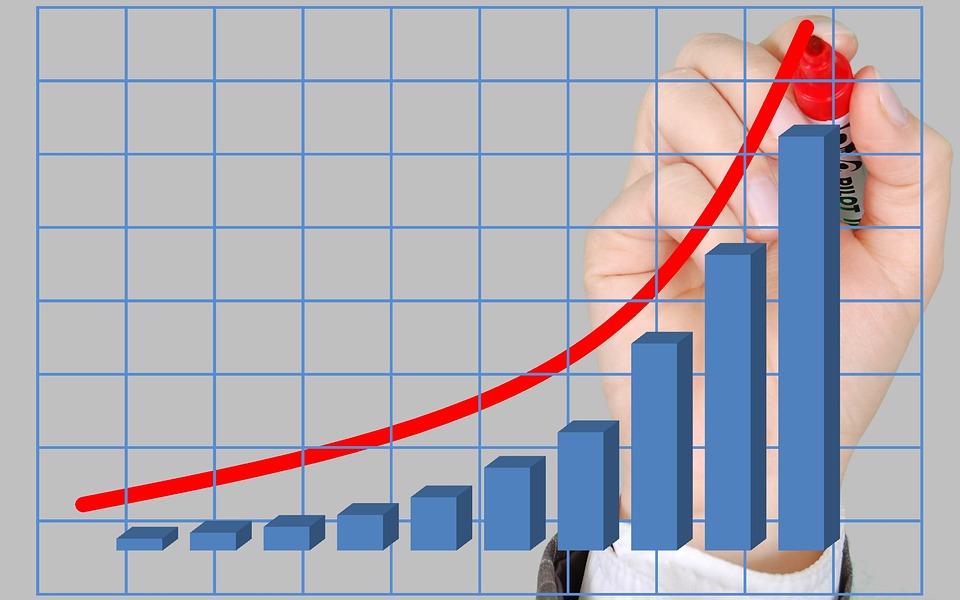

Jobs: The October Job Openings and Labor Turnover Survey (JOLTS) was lighter than expectations (8.733M versus estimates of 9.300M) but still remained at an extremely elevated level (anything above 7M).

Services: The November ISM Non Manufacturing (Services) PMI beat expectations, 52.7 versus estimates of 52.0. Prices Paid remained high at 58.3 but were lower than the previous month's 58.6. The Employment Index gained some ground rising from 50.2 to 50.7.

Today's Potential Rate Volatility: High

This morning markets have a slight positive lean. Volatility has started high as markets digest labor data.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.

Source: TBWSAll information furnished has been forwarded to you and is provided by thetbwsgroup only for informational purposes. Forecasting shall be considered as events which may be expected but not guaranteed. Neither the forwarding party and/or company nor thetbwsgroup assume any responsibility to any person who relies on information or forecasting contained in this report and disclaims all liability in respect to decisions or actions, or lack thereof based on any or all of the contents of this report.

Millenium Home Mortgage

Manager

NMLS: 51519

Millenium Home Mortgage LLC

1719 Route 10 East, Suite 206, Parsippany NJ

Company NMLS: 51519

Office: 973-402-9112

Email: connie@mhmlender.com

Millenium Home Mortgage

___

Manager

NMLS: 51519

Last articles

___

Revisiting pandemic “boomtowns” - a study in staying power

5/1/2024

The shot heard ‘round the world was the boom many cities experienced during the ... view more

How to avoid homebuyer ‘shot-in-foot’ syndrome

4/30/2024

You don’t simply buy a home these days. You compete for one. The home-buying sea... view more

Higher than expected Employment Cost Index raises inflation concerns

4/30/2024

The 1st QTR Employment Cost Index was higher than expected, up 1.2% versus estim... view more

This week markets will be focused on FOMC and the employment report

4/29/2024

The headlines this week, the FOMC meeting on Wednesday and April unemployment da... view more

When a gambling addiction affects ‘home sweet home’

4/26/2024

It’s the nightmare we think only happens in the movies. “We have to pack,” says ... view more

Elegant decor updates need not break the bank

4/24/2024

Ever notice how some of the most elegant clothing and beautiful home decor have ... view more

Ushering ‘porch birds’ to a different locale

4/23/2024

You may see it as a sign of good luck when a wild bird or two visits your porch.... view more

The Richmond Fed Manufacturing Index met expectations

4/23/2024

We will get the high-frequency S&P Markit MFG and Services PMI at 9:45 am ET. Bo... view more

Never underestimate the value of professional real estate agent representation

4/22/2024

Click the link; buy a sofa. Click on another; buy a pergola for your backyard...... view more

The PCE data on Friday will dominate market news

4/22/2024

The 10 year note at 8:30 am ET improved from overnight levels, at 8:30 am 4.64% ... view more

Load more

Millenium Home Mortgage LLC

Millenium Home Mortgage LLC